Two Lubbock County Commissioner candidates, Jason Corley and Chad Seay, raised concerns about the upcoming county budget. They said potential cuts to the Lubbock County Sheriff’s Office could make the community less safe.

A budget memo sent to department heads on Monday said, “The County is experiencing a period of budgetary restrictions.”

The memo also said, “The taxpayers of Lubbock County want reduced taxation and therefore the effective tax rate is expected to be adopted as proposed by the Commissioners’ Court this morning.”

The effective tax rate is roughly one penny per $100 of property value less than the current rate.

“Maintaining current operations, addressing technology needs and reducing taxes are budget priorities,” the memo said.

According to a document on the county’s web site, the effective tax rate is defined as “the tax rate that would generate the same amount of revenue in the current tax year as was generated … in the preceding tax year…”

Homeowners, on average, would pay the same under the effective rate.

In summary, the memo gave four instructions to department heads. It said no pay raises; (for the most part) no additional personnel; there will be restrictions on changes to line items; and no capital improvements.

Sheriff Kelly Rowe said the instructions could prevent him from replacing patrol units, getting body armor for officers, finishing radio upgrades that are required by federal law and purchasing video equipment.

Rowe also quoted current commissioners as saying the incoming commissioners could “eat crow” concerning the current budget process which will be finalized before Corley and Seay will take office.

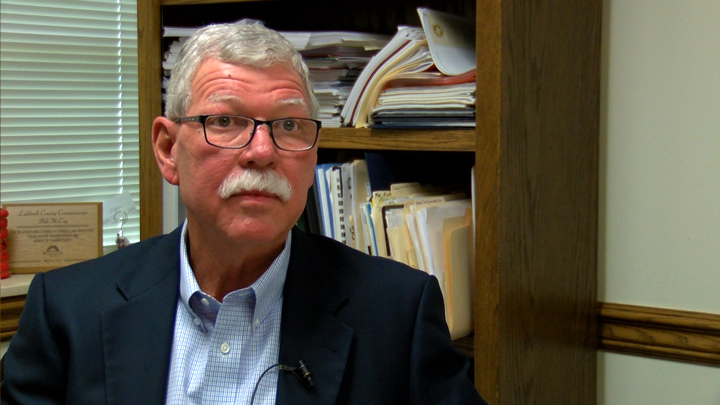

County Commissioner Bill McCay said that’s not true.

Tongue-in-cheek, McCay said he has not talked to anyone about crows or ravens or dove hunting. In a more serious tone, he said he has not heard that kind of talk from any of the current commissioners.

McCay said the county needs to trim almost $2 million to keep the effective tax rate.

The sheriff said his proposed budget would go from $15.285 million to $13.391 million. That’s on top of cuts he had already been asked to make in preparation for the coming budget year.

In other words, he feels like his department is taking the brunt of the budget burden.

Rowe said, “If your motivation is purely malicious, then that makes absolutely no sense whatsoever, because the people suffering first and foremost are going to be the taxpayers.”

Rowe said, “Secondly it is going to be the men and women asked to do some of the most dangerous work [who suffer].”

McCay sees it differently.

He said, “When you look at the sheriff’s budget it actually increased a year ago from $13 million to over $15 million.”

McCay also said, “It’s tough trying to make budget decisions, but we did not cut out body armor. We did not cut out things that are going to keep their folks safe.”

“We’re still using pencil, at this point in the budget process,” McCay said. “We’re not using ink. It’s still pencil, and so we are working with all departments on what they have requested.”

“We spend no less than three months doing budget preparations each year,” Rowe said. So, to get the memo on Monday, Rowe said, is short notice.

A copy of the text of the memo is below:

FY 19 BUDGET MEMO

To: Department Directors and Elected Officials

From: Budget Committee

Date: 8/13/2018

Re: FY 2019 Budget Reduction

The County is experiencing a period of budgetary reductions. The taxpayers of Lubbock County want reduced taxation and therefore the effective tax rate is expected to be adopted as proposed by the Commissioners’ Court this morning. The effective tax rate is approximately one cent less than the current tax rate. As a result, increased budget requests for FY19 over FY18 appropriations cannot be funded.

■ COLA or Merit increases will not be funded.

■ If you requested additional personnel for FY19 you will receive a separate notice, but the majority of the personnel requests were not approved and will not be funded. This budget continues to reflect FY18 personnel appropriations.

■Operating line items have been reduced to the lessor of — the amount funded in FY18 or the amount requested for FY19. We have made an effort to include the detail provided, but to facilitate purchase orders in FY19 please review and update the detail as needed. To reduce line item transfers next year, you may move funds between your operating line items, but you cannot increase the overall operating budget or move funds to personnel or capital line items.

■ Capital expenditures and some non-critical permanent improvement upgrades and renovations must be postponed to future budgets. All capital expenditure requests have been removed from your budget and will not be funded in FY19.

Your time and effort spent on preparing your FY19 Budget request is greatly appreciated. Thank you to those departments making reductions when first asked to do so. The decision to reduce budgets even further was made after much deliberation. Maintaining current operations, addressing technology needs and reducing taxes are budget priorities and will require using reserves to fund the FY19 budget after these further cuts are made.

In order to stay on schedule, any updates to your budget must be returned to the Auditor’s Office no later than 10:00 am on Wednesday, August, 16, 2018. No email submissions will be accepted. If you have any questions, please contact the Auditor’s Office.

Thank you for helping make our local government work!

(James Clark | jclark@klbk13.tv and Emily Harrison | eharrison@klbk13.tv contributed to this report.)