(ABC NEWS) – It’s officially the new year, which means, among other things, it will be time to file your taxes in no time.

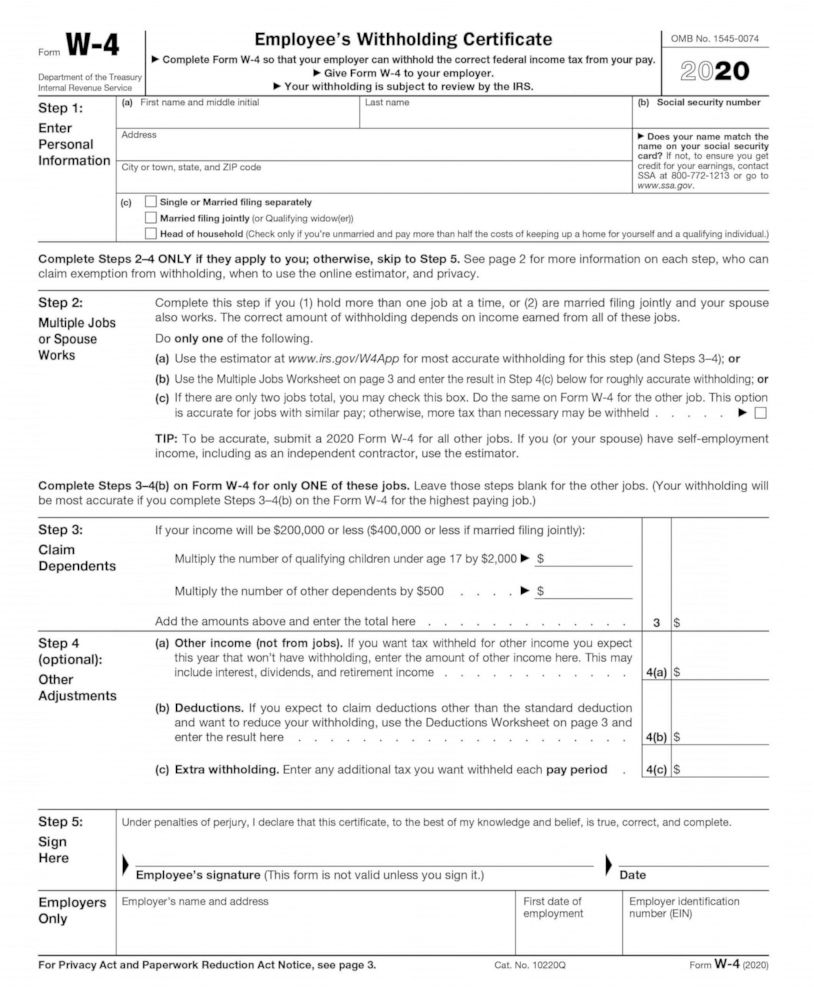

But in 2020, for the first time in more than three decades, the IRS has given its W-4 form — which determines how much federal income tax is withheld from your paycheck — a makeover. The agency says the revamped design “reduces the form’s complexity” and helps with the “transparency and accuracy of the withholding system.”

Basically, it drops the language of allowances, which may be confusing for some, in favor of a series of questions about your income and dependents.

(Photo from ABCNews.com; Courtesy: IRS)

“The new draft Form W-4 reflects important feedback from the payroll community and others in the tax community,” IRS Commissioner Chuck Rettig said in a statement when the new design was unveiled in May. “The primary goals of the new design are to provide simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors.”

Here is everything you need to know about the new form:

Why the redesign?

Essentially, the IRS says the revamp is supposed to make it a little easier for everyone to understand.

“While it uses the same underlying information as the old design, it replaces complicated worksheets with more straightforward questions that make accurate withholding easier for employees,” the IRS says on its website.

What is different about the new W-4?

Tax service company H&R Block breaks down what new W-4 form encompasses next to the old one here.

Essentially, it is very similar. Taxpayers now have different filing status choices in the new form. There are also more options to choose from if you have changed jobs, dependents, or filing status.

The “total number of allowances” section is now gone. Instead of calculating the number of allowances, which translates into a certain amount of tax withheld (the more allowances, the less money is withheld), the form features questions about your income and dependents. There is also a new optional “Step 4” section on the new form for other adjustments such as deductions for mortgages.

Allowances were also tied to the personal tax exemption, which was eliminated in 2017.

“In the past, the value of a withholding allowance was tied to the amount of the personal exemption,” the agency writes on its website. “Due to changes in law, currently you cannot claim personal exemptions or dependency exemptions.”

Is everyone required to submit the new Form W-4?

No. Workers who have used Form W-4 in any year before 2020 are “not required to furnish a new form merely because of the redesign,” according to the IRS. “Employers will continue to compute withholding based on the information from the employee’s most recently furnished Form W-4.”

H&R Block recommends you re-submit a new W-4 form when you start a new job, get married, have a child, or if you want a more accurate withholding.

For more information on the new form for both employees and employers, the IRS has rolled out a dedicated FAQ page for the new W-4 here.

(Information from ABCNews.com)